How to get COVID19 economic impact payment: Are you a U.S citizen and your income is affected by the global pandemic and you want to apply for the Economic impact payment, then this page is designed to walk you through on everything to help you get your economic impact payment as soon as possible.

Although the IRS is committed to helping you get your 2020 Economic Impact Payment as soon as possible. The payments also referred to by some as stimulus payments, are only made for taxpayers. To get my COVID-19 economic Impact payment by taxpayers who filed tax returns in 2018 and 2019 and most seniors and retirees, no further action required. from them.

Before we go ahead to show you how to apply for the 2020 COVID-19 Economic Impact payment online at sa.www4.irs.gov Economic Impact payment portal, we shall first show you what makes one eligible for the COVID19 economic impact payment.

Who Is Eligible for U.S.A COVID19 Economic Impact Payment.

Although some filers, such as high-income filers, will not qualify for an Economic Impact Payment, most will.

Taxpayers likely won’t qualify for 2020 Economic Impact Payment if any of the following apply:

- You must be a U.S. citizen, permanent resident, or qualifying resident alien.

- Your adjusted gross income is greater than

- $99,000 if your filing status was single or married filing separately

- $136,500 for a head of household

- $198,000 if your filing status was married filing jointly

- You can be claimed as a dependent on someone else’s return. For example, this would include a child, student, or older dependent who can be claimed on a parent’s return.

- You do not have a valid Social Security number.

- You are a nonresident alien.

- You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019.

Note: A Social Security number is required to receive a COVID-19 stimulus check. Also if you’ve been claimed as a dependent on someone else’s 2019 tax return, you aren’t eligible to receive a stimulus payment.

How to File COVID19 Economic Impact Payment

The vast majority of people do not need to take any action to get U.S Economic Impact payment online. This is because the IRS will calculate and automatically send the 2020 economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment.

The Covid19 economic impact payment will be deposited directly into the same banking account reflected on the return filed.

So to get your 2020 Economic Impact payment online, you DO NOT need to take any further action if you filed a federal income tax return for 2018 or 2019. In the same way, as we said above, if you already filed your tax return for 2019, the IRS will use this information to calculate the COVID19 Economic Impact Payment amount.

If you haven’t filed your tax return for 2019 but filed a 2018 federal income tax return, the IRS will use the information from your 2018 tax return to calculate the Payment amount.

How to Check Your 2020 Economic Impact Payment Status Online

To check the status of your Economic Impact Payment, note the following

This application will give you information about:

- Your payment status

- Your payment type

- Whether the IRS needs more information from you, including bank account information

You May Need:

- Your 2019 return, if filed, and

- Your 2018 return

Data is updated once per day overnight, so there’s no need to check Economic Impact Payment status back more than once per day.

Note: If you receive an SSA or RRB Form 1099 or SSI or VA benefits, your information is not yet available in the application.

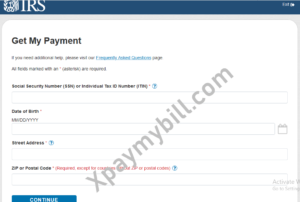

How to Apply for Economic Impact Payment at sa.www4.irs.gov

The following guideline below is how to get COVID19 economic impact payment online at sa.www4.irs.gov

- Go to https://sa.www4.irs.gov/irfof-wmsp/login

- Enter your Social Security Number (SSN) or Individual Tax ID Number (ITIN) *

- Date of Birth * MM/DD/YYYY

- Click Date of Birth icon button to select a date from the calendar

- Street Address *

- ZIP or Postal Code * (Required, except for countries without ZIP or postal codes)

Note: All fields marked with an * (asterisk) in the 2020 Economic Impact Payment application form online are required. If you have further questions about how to get COVID19 economic impact payment, use the comment section below.