Merrick Bank Credit Card is considered one among the top 25 Visa cards. Cardholders of Merrick bank access their account 24/7 using the cardholder’s Center. So if you don’t have a card yet with the bank, here is how to go about Merrick Bank Credit Card application.

If you’ve received an offer from the company, it means your credit profile met the standards and qualified you for an offer. Are you looking to build or rebuild your credit? Want a better way to take control of your finances? The Merrick Bank Secured Visa card is for you!

RELATED: Capital one Credit Card Payment – How to Make a Capital One Credit Card Pay Bill

Merrick Bank Visa Credit Card Benefits

- Monthly FICO Score for free. This a free update from a credit bureau, complimentary benefits for cardholders.

- Flexibility Payment Options. When cardholders pay on time it simply builds up their credit account.

- Free Online & Mobile Access. Cardholders account can be accessed online in Merrick Bank Credit

- Cardholders center that is always available 24/7 at when convenient. It can be done by using the mobile app, desktop or tablet.

- Zero Liability for Unauthorized Use. Zero liability policy is an offer to cardholders such that they won’t be responsible for any unauthorized charges or account information.

- Automatic Credit Line Review. The cardholder’s account is automatically reviewed for credit line increases.

- Account Alerts. In the Merrick Bank, Credit Card cardholders center or the Merrick Bank go mobile App one card set up an alerts information to inform them of changes to their account.

- Paperless Statement Option. Merrick Bank Credit Card offers cardholders with Paperless Statement, which gives access to online statements at a click of the mouse. It’s friendly, it’s clutter-free. There is no loss or it being stolen through paper delivery channels.

- Free Financial Education. Learning on the latest Credit-building, budgeting, and money management resources.

Merrick Bank Credit Card Rates And Fees

- Balance Transfer Intro APR – Not Applicable

- Balance Transfer Regular APR – Not Applicable

- Annual Fee – $0 – $70

- Purchase Intro APR – Not Applicable

- Purchase Regular APR – 20.95% – 29.2%* Variable

How To Apply For Merrick Bank Visa Card Application

- Go to the official website of the bank at https://securedcard.merrickbank.com/Application.aspx

fill in your Personal information such as First Name, Middle Name, last name, Suffix, - Street address, Street Name, Unit/Apt/Suite

- City, State, Zip Code, Email address, Phone number, date of birth, Social Security Number, Mother’s Maiden Name.

- Click on the ‘continue to next step‘ button

- Next, fill in your Financial information, E-Sign Disclosure, Summary of Terms, Fund Your Account, and application Summary to complete your application.

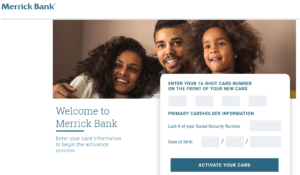

How To Activate Merrick Bank Credit Card

- Using any browser of your choice

- Enter this Weblink https://www.merrickbank.com/activate

- On the new page fill in the information needed

- Enter your 16 digits card number on the front of your new card

- Primary cardholder information

- Last four digits of your social security number and Date of birth

- Scroll down and click on the “Submit” button

How To Login To Merrick Bank Visa Card

- Get to the login webpage

- Navigate to the left side of the page

- Enter your Username and Password

- Click on the login button

How To Recover Merrick Bank Credit Card Username and Password

- On the log in section of the credit card page

- Scroll down and click on the “Forgot Username or password” link

How To Make Bill payment With Merrick Bank Credit Card.

Making a payment with Merrick Credit Card is easier and it’s in three medium;

- Online payment – this is achieved by setting up a one-time online payment from your account, track your spending, download statements, and more.

- Using mobile – Download Merrick Bank mobile app for quick and easy payment options

- Using phone –call this number. 1-800-204-5936.

Merrick Bank Credit Card Customer Service Number

For further information and inquiries on this credit card call the customer service Representative. 1-800-253-2322, 1-800-660-8953.